Using a vehicle personal loan normally permits you to qualify for Chapter seven bankruptcy much more simply as you can deduct an extra car or truck possession price on the implies take a look at.

Certainly. 1000s of people today use debt consolidation applications annually to deal with their toughest credit history complications. It's a good idea to look into the standing of any plan you're looking at: learn what other clients say regarding their activities, see if the BBB has rated the corporation, and figure out yourself if their credit card debt consolidation services are really worth your time and effort and (probably) income.

One way to stay away from bankruptcy is to amass a minimal interest level financial loan and pay back all that actually costly personal debt. Upstart knows that a credit history score isn't the only aspect to take into account when evaluating your loan application.

If you want to take out a private loan after bankruptcy, it’s essential you improve your credit history score by making payments punctually As well as in full.

Below Every bankruptcy kind, it is possible to make an application for a private financial loan as soon as your personal debt is discharged. However, it’s much easier so that you can make an application for financial loans after Chapter seven bankruptcy because it normally takes less time to discharge your personal debt.

We have aided 205 clients uncover attorneys these days. There was an issue with the submission. Remember to refresh the site and try again

Definitely! This is actually the primary reason why we are in company - that can help men and women get the automobile personal loan they need, no matter how superior or negative their credit rating rating may be.

Credit score.org is usually a non-financial gain assistance my blog that has a forty five-yr in addition record of excellence and integrity. On top of that, their economical coaching for bankruptcy alternate options is obtainable at Totally no demand. It's crucial to know how Credit score.

On typical, Chapter seven bankruptcy takes about four to six months to complete. In contrast, it normally takes as much as five years to discharge debt under Chapter 13 bankruptcy. After your personal debt is discharged, it is possible to apply for read this new credit rating.

Obtaining a personal loan will help you re-build credit. It means that you can make well timed installments on a large-ticket financial debt, which often can support establish a good credit score report. Financing may be your very best choice if investigate this site you need an auto but haven't got the cash to pay for it.

Supplemental options for retaining an auto in Chapter seven bankruptcy exist when you have an automobile personal loan. For example, it index is possible to "redeem" the car or truck, which involves having to pay the lender its real price. Study all of your why not check here vehicle alternatives in Chapter 7 Bankruptcy.

For more than twenty five several years, CuraDebt has assisted folks get along with the things they owe by means of many different bankruptcy choices. You only spend fees Once your debts are managed, so you'll however preserve a lot of cash.

Prior to deciding to borrow any funds and tackle more debt, you must create a funds. Try to remember, missing one payment could damage your credit score rating, which may by now be struggling as a result of bankruptcy.

Access Money makes a speciality of loans for the goal of preventing bankruptcy. The corporate has a terrific popularity, both While using the BBB and its purchasers.

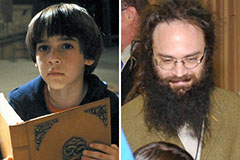

Barret Oliver Then & Now!

Barret Oliver Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!